New Membership

You will need the following information to complete the application:

A Regular Share Account is opened when you join the Credit Union. This basic savings account must be maintained to preserve your membership. Dividends are earned from the date of deposit to the date of withdrawal and are paid and compounded quarterly.

APY: 0.15% Min Deposit: $5.00

Free checks-Free BillPay-Free Debit card with Rewards. No dividends paid on this account.

Min Deposit: $25.00

• Dividend rate for balances $500 - $10,000 – 3.50% APY

• Dividend for balances $10,000.01 or greater – 0.15% APY

• Must have 15 posted debit card transactions, direct deposit, receive e-statements, and log into online banking monthly.

Min Deposit: $25.00

The Member-Managed Funds account is a special high-yielding investment account perfect for short-term funds! The dividend rate is tiered based on the balance. Dividends are posted monthly.

Max APY: 2.00% Min Deposit: $2,500.00

This account earns dividends like a certificate account - without the large deposit. With a minimum monthly recurring deposit of just $25.00.

APY: 2.00% Min Deposit: $25.00

This account earns dividends like a certificate account - without the large deposit. With a minimum monthly recurring deposit of just $25.00,

APY: 3.00% Min Deposit: $25.00

Fixed rate share account with a fixed term of 6 months. This certificate account has a minimum account balance of $2,500. Dividends compound monthly. There is an early withdrawal penalty of an amount equal to 90 days dividends.

APY: 4.00% Min Deposit: $2,500.00

Fixed rate share account with a fixed term of 12 months. This certificate account has a minimum account balance of $2,500. Dividends compound monthly.There is an early withdrawal penalty of an amount equal to 90 days dividends.

APY: 4.00% Min Deposit: $2,500.00

Fixed rate share account with a fixed term of 18 months. This certificate account has a minimum account balance of $500. Dividends compound monthly. There is an early withdrawal penalty of an amount equal to 180 days dividends.

APY: 4.00% Min Deposit: $500.00

Fixed rate share account with a fixed term of 24 months. This certificate account has a minimum account balance of $500. Dividends compound monthly. There is an early withdrawal penalty of an amount equal to 180 days dividends.

APY: 4.00% Min Deposit: $500.00

Fixed rate share account with a fixed term of 36 months. This certificate account has a minimum account balance of $500. Dividends compound monthly. There is an early withdrawal penalty of an amount equal to 180 days dividends.

APY: 3.75% Min Deposit: $500.00

Fixed rate share account with a fixed term of 60 months. This certificate account has a minimum account balance of $500. Dividends compound monthly. There is an early withdrawal penalty of an amount equal to 180 days dividends.

APY: 3.75% Min Deposit: $500.00

Savings account in which all debit card transactions made through the checking or savings account are rounded to the nearest dollar and the difference is deposited in this account. Dividends are earned from the date of deposit to the date of withdrawal and are posted to the account quarterly. No additional deposits allowed.

APY: 1.00%

APY: 0.10% Min Deposit: $1.00

A Money Market Account (also called Member-Managed Funds Account) offers higher dividends than a regular savings account. This is a tiered account, so the more you save, the more you earn! The minimum opening deposit is $2,500. Dividends are earned from the date of deposit to the date of withdrawal and are posted to the account monthly.

Max APY: 2.00% Min Deposit: $2,500.00

This special account can be personalized by you for a specific purpose. You name it and decide how to use it! Dividends are earned from the date of deposit to the date of withdrawal and are posted to the account quarterly.

APY: 0.10% Min Deposit: $1.00

This account is specially designed for vacation savings. Dividends are earned from the date of deposit to the date of withdrawal and are posted to the account quarterly.

APY: 0.10% Min Deposit: $1.00

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

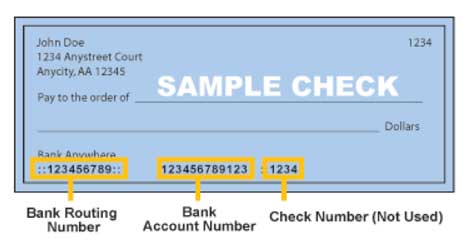

Funding

This account does not have sufficient balance to cover the total required deposit.

Please select another account.

'Doing Business As' Information

Tell Us About Yourself

Please take a picture or upload a copy of your ID document such as driver license or state ID with photo.

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Joint Applicant Information

Please take a picture or upload a copy of your ID document such as driver license or state ID with photo.

Beneficiaries Information

Review and Submit

(1) The number entered on this form is my correct taxpayer identification number,

(2) I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

(3) I am a U.S. person (including a U.S. resident alien). *

By clicking "I agree," you authorize the Credit Union to verify the information you submitted and to obtain credit related reports and any additional verification as needed to establish your identity and eligibility. Upon your request, we will tell you which credit report was obtained and give you the name and address of the credit reporting agency that provided the report. You uphold the information you submitted to be true and correct. By submitting this application, you agree to allow the Credit Union to receive the information contained in your application, as well as the status of your application.

Authentication Questions

Application Completed

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

You're logged in as

You're logged in as